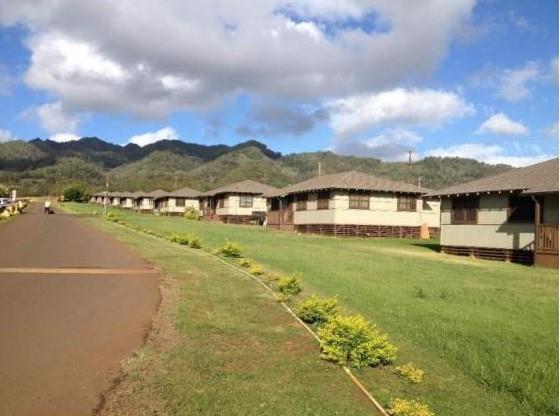

Tax Credits for Rehabilitation of Historic Buildings Seminar

Historic Hawai‘i Foundation, in partnership with the Hawai‘i State Historic Preservation Division and Department of the Interior’s National Park Service, provided a seminar on the Federal Historic Preservation Tax Incentives program on December 5, 2023.

VIEW THE RECORDING AND PRESENTATION BELOW.

The seminar provides training to historic property owners, developers, financiers, tax and accounting, real estate, architects, land use and planning professionals on the Historic Tax Credit programs available in the State of Hawai‘i and the use of federal historic tax credits to rehabilitate historic buildings.

Historic Tax Credits Seminar

Date: Tuesday, December 5, 2023

Time: 9:00 a.m. – 12:00 p.m.

This seminar has been approved for 3 AIA/CES LU (AIA Honolulu is the registered provider) and submitted for certificate maintenance credits through the American Institute of Certified Planners (AICP).

BACKGROUND

The Federal Historic Preservation Tax Incentives (aka Historic Tax Credit) program encourages private sector investment in the rehabilitation and re-use of historic buildings. It creates jobs and is one of the nation’s most successful and cost-effective community revitalization programs.

A 20% income tax credit is available for the rehabilitation of historic buildings that are determined to be “certified historic structures.” The buildings must be considered depreciable under the Internal Revenue Code, such as in a business, commercial, or other income-producing use. The State Historic Preservation Division (SHPD) and the National Park Service (NPS) review the rehabilitation work to ensure that it complies with the Secretary of the Interior’s Standards for Rehabilitation. The Internal Revenue Service (IRS) defines qualified rehabilitation expenses on which the credit may be taken. Owner-occupied residential properties do not qualify for the federal rehabilitation tax credit.

Additional State of Hawai‘i income tax credits and local County property tax exemptions are available for rehabilitation and preservation of historic properties. Other federal tax credits that may be used in historic preservation projects include Affordable Housing Tax Credits and Preservation Easement Tax Credits.

ABOUT THE SEMINAR

The purpose of this program is to educate historic property owners, developers, financiers, tax and accounting, real estate, architects, land use and planning professionals on the Historic Tax Credit programs available in the State of Hawai‘i and the use of federal historic tax credits to rehabilitate historic buildings. The seminar will explain the basics of the federal and Hawai‘i historic tax credits, why and how developers/owners use them, and how they have been catalytic for community benefits.

The seminar will provide subject matter experts to explain the parameters of the federal and state income tax credit programs, including eligible properties, eligible expenses, rehabilitation criteria, application procedures, and claiming the credit. The presentations will include case studies to showcase different funding sources and financing strategies to engage in preservation planning and financing of affordable housing and community preservation projects.

LEARNING OBJECTIVES:

- Objective 1: Understand eligibility requirements for Historic Tax Credits;

- Objective 2: Understand the application procedures for Historic Tax Credits;

- Objective 3: Understand the concepts of certified historic structures, applying the Standards and Guidelines for the Rehabilitation of Historic Buildings, and qualified rehabilitation expenses;

- Objective 4: Understand funding sources and financing strategies through combining historic and affordable tax credits and through syndicating tax credits.

The program will conclude with audience Q&A and discussion. Participants submit questions beforehand to andrea@historichawaii.org.

WHO SHOULD ATTEND?

• Developers and private entities that own or manage historic and potentially historic properties in Hawai‘i;

• Realtors, financiers, tax and accounting professionals whose clients own or manage historic and potentially historic properties in Hawai‘i;

• Government agencies and elected officials responsible for the protection of historic properties;

• Design professionals, including planners, architects, engineers, landscape architects, historians and architectural historians;

• Community organizations or individuals with stewardship responsibilities for historic properties;

• Other members of the public or organizations interested in preserving historic sites.

PRESENTERS

Jessica Puff is the Architecture Branch Chief at the Hawai‘i State Historic Preservation Division and a University of Michigan Architecture PhD Candidate.

John Sandor has worked as an architectural historian in the Technical Preservation Services Branch of the National Park Service since 1996. He reviews rehabilitation projects seeking certification for federal tax credit and provides assistance to the users of the program and the general public on technical aspects of preservation. Sandor speaks frequently on windows for historic buildings and a variety of other issues relating to the application of the Secretary of the Interior’s Standards for Rehabilitation. He is the lead author of the newly revised Preservation Brief #16, The Use of Substitute Materials on Historic Buildings. After graduating from Carnegie Mellon University in architecture he spent time as a carpenter and preservation consultant before serving as the architectural coordinator for the West Virginia State Historic Preservation Office.

Dr. Elaine Jackson-Retondo, Region Preservation Partnerships and History Programs Manager, Interior Regions 8, 9, 10 and 12 in the National Park Service Pacific West Regional Office, earned her Doctorate in Architectural History and Masters of Architecture from the University of California, Berkeley and her Bachelor of Architecture from the University of Notre Dame in South Bend, Indiana. She has worked in the National Park Service since 2002.

Jackson-Retondo’s current and past work has included the National Park Service’s American Latino Heritage Initiative, Asian American Pacific Islander Initiative, Japanese American confinement during World War II, Cesar Chavez and the Farm-worker Movement, the National Park Service’s Mission 66 Program, and 19th century carceral institutional landscapes.

Kiersten Faulkner is the chief executive of Historic Hawai‘i Foundation and oversees all aspects of its preservation programs, strategic planning, business lines and operational matters. She holds a Master of Arts in Urban and Environmental Policy from Tufts University and is a member of the College of Fellows of the American Institute of Certified Planners (FAICP).

Shelby Mendes earned her Doctor of Architecture degree from the University of Hawaii at Manoa, with her dissertation Case Study Analysis of a Successful Preservation Project in Honolulu: Dearborn Chemical Company Building. Shelby works at FAI Architects, which specializes in architecture, planning, and historic preservation projects.

Mark Hashem is an Associate with SofosRealty Corporation. He graduated from Pacific University in Forest Grove, Oregon and earned his MA from at Hokkaido University in Japan. He has represented the East Honolulu district in the Hawai‘i House of Representatives since 2010.

John Lee has over 16 years of experience in the affordable housing industry. He is the Managing Director of Funds Management at Hunt Capital Partners, LLC (HCP). HCP specializes in the syndication of Federal and State Low-Income Housing, Historic and Solar Tax Credits. Lee is primarily responsible for overseeing the Funds Management department that prepares, analyzes, and monitors financial projections for all operating partnerships and fund level investments. Additionally, he is responsible for working with investors and attorneys structuring certificated and allocated state tax credit investments. Prior to joining HCP, Lee was an Underwriter for a nationally recognized non-profit tax credit syndication firm and a Senior Accountant at Novogradac & Company LLP. Lee is a graduate of the University of California at Irvine.