11/19/2021: Governor David Y. Ige has directed State of Hawai‘i Agencies to take specific steps to improve compliance with the statutes and administrative rules governing the historic preservation review and compliance procedures for both government projects and for private development that requires permits or other government approvals.

In a Memo distributed to the State Agency Directors and Cabinet on November 2, Governor Ige said:

“As part of our Administration’s ongoing effort to make government more efficient and effective, the staff (special kudos to Sara Lin) has worked closely with your departments to identify chokepoints and roadblocks. DLNR’s State Historic Preservation Division (SHPD) review touches almost everything: affordable housing, clean energy projects, infrastructure, etc. However, they receive more reports than they have time to review.

“The Governor’s office has been facilitating a public-private Working Group to identify priorities and revise its Administrative Rules to address this issue, among others.

“As a first step, the Working Group and SHPD staff wrote the attached Governor’s Memorandum aimed at helping State Agencies have a smoother path through the historic review process. This includes helping agencies better understand SHPD’s submission requirements and knowing how to hold your consultants accountable to good work, as SHPD staff currently spends a lot of time reviewing incomplete reports.”

The Memo includes additional attachments and references, including:

- SHPD Mandatory and Unnecessary Submittal List

- SHPD Submittal Checklist

- SHPD Reviews and Hawai‘i Cultural Resource Information System (HICRIS) Submittals in Five Steps

SHPD is planning to conduct one-hour training sessions with the agencies to assist them with compliance.

The Memo and directive to the State Agencies is the first step in a longer process to update and revise the historic preservation review process that is required by Hawai‘i Revised Statutes (HRS) 6E.

Governor Ige established a working group to review the SHPD Administrative Rules that provide the procedures and standards for assessing the potential effect of development projects on historic properties. HHF Executive Director Kiersten Faulkner is a member of the working group, which has met 2-3 times per month since April.

The Constitution of the State of Hawai‘i recognizes the value of conserving and developing the historic and cultural property within the State for the public good, and the Legislature has declared that it is in the public interest to engage in a comprehensive program of historic preservation at all levels of government to promote the use and conservation of such property for the education, inspiration, pleasure and enrichment of its citizens.

In order to meet this mandate and to ensure that the historic and cultural resources of Hawai‘i are treated appropriately, it is necessary to have a framework based on criteria and standards to define and differentiate which properties are subject to the state’s historic preservation program, and then to assess whether and how proposed actions have the potential to affect those properties. The review process then needs to resolve any potential effects and result in binding and implementable agreements without ambiguity.

Hawai‘i State Law (HRS §6E-8, §6E-10 and §6E-42) requires that prior to issuing any permit or land use approval for any project that affects a historic property, state and local jurisdictions shall refer the matter to SHPD for review, comment and –for public projects—written concurrence before they proceed. The referral applies to any property over 50 years old, except for dwellings that are not listed on or nominated to the State Register of Historic Places.

Hawai‘i Administrative Rules (HAR) 13-275 (for public projects) and 13-284 (for private projects) provide the procedures, standards and resolution of projects. The rules were adopted in 2003 and need to be updated for consistency, clarity, effectiveness and in response to current technologies and issues.

Once the working group completes its tasks and the administration completes the draft rules, DLNR will hold public hearings prior to finalizing and adopting the new rules.

ATTACHMENT:

RESOURCES

- SHPD 6E-8 and 6E-42 Review Processes

https://dlnr.hawaii.gov/shpd/hrs-6e-8-6e-42-review-process/ - SHPD Statutes and Administrative Rules

https://dlnr.hawaii.gov/shpd/rules/

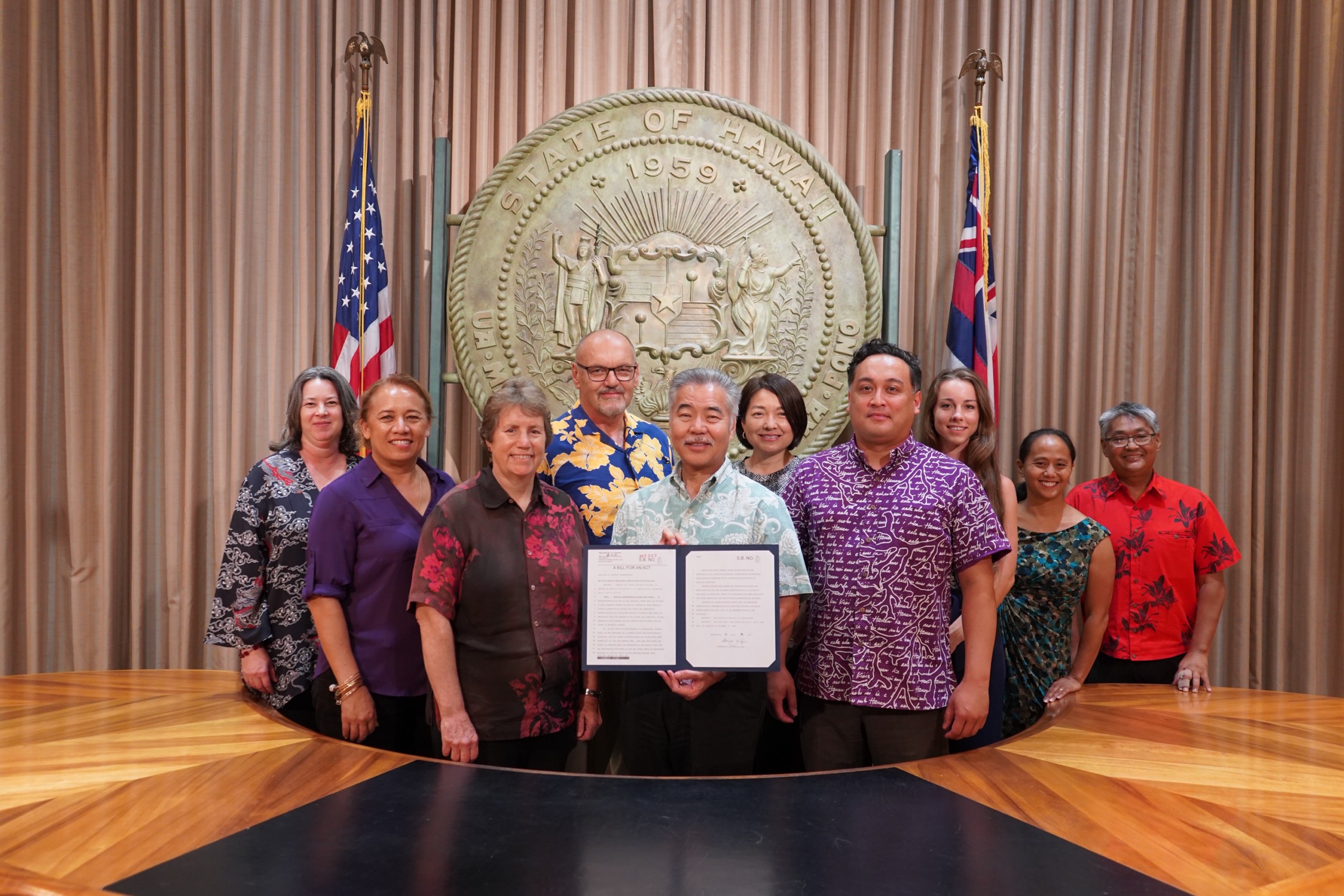

Image above: In July 2019, Governor Ige signed SB 1394 to establish a state tax credit to support rehabilitation of historic properties. The tax credit is available for 30% of the qualified expenditures to preserve and rehabilitate certified historic buildings. The total amount of the cumulative credit is capped at $1,000,000 per year. The tax credit took effect on July 1, 2019 and is authorized for five years. [Learn more]